CLV Advertising Guide 2026

Master CLV-based advertising in 2026. Learn to calculate customer lifetime value, optimize acquisition for LTV, and build campaigns that attract...

Key Takeaways

- 1**LTV:CAC ratio determines sustainability** — Target 3:1 or higher; below 1:1 means you're losing money per customer

- 2**Not all customers are equal** — Top 20% of customers typically generate 80% of lifetime value

- 3**First purchase predicts lifetime** — Discount buyers have 50% lower LTV than full-price buyers

- 4**Payback period matters** — How quickly CAC is recovered affects cash flow and growth capacity

Key Takeaways

- LTV:CAC ratio determines sustainability — Target 3:1 or higher; below 1:1 means you're losing money per customer

- Not all customers are equal — Top 20% of customers typically generate 80% of lifetime value

- First purchase predicts lifetime — Discount buyers have 50% lower LTV than full-price buyers

- Payback period matters — How quickly CAC is recovered affects cash flow and growth capacity

- Platform algorithms can optimize for LTV — With proper setup, AI finds customers who stay, not just convert

What Is Customer Lifetime Value?

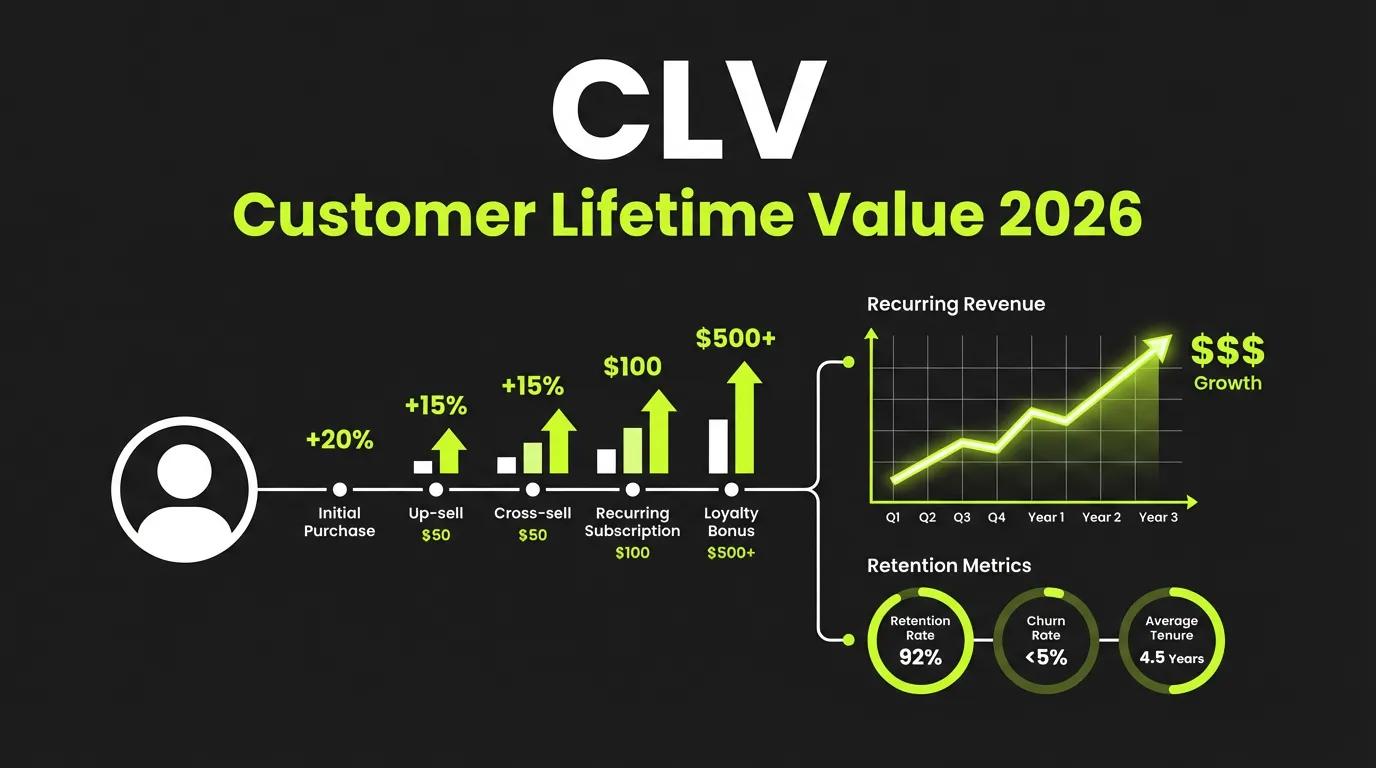

Customer Lifetime Value (CLV or LTV) is the total revenue a customer generates over their entire relationship with your business, minus the costs to serve them.

Or more simply: CLV = Average Revenue Per Customer × Gross Margin × Retention Period

Why CLV Matters for Advertising

| Metric | What It Tells You |

|---|---|

| CLV | Total value of customer relationship |

| CAC | Cost to acquire that customer |

| LTV:CAC | Profitability of acquisition |

| Payback Period | Time to recover CAC |

| CLV by Channel | Which channels attract valuable customers |

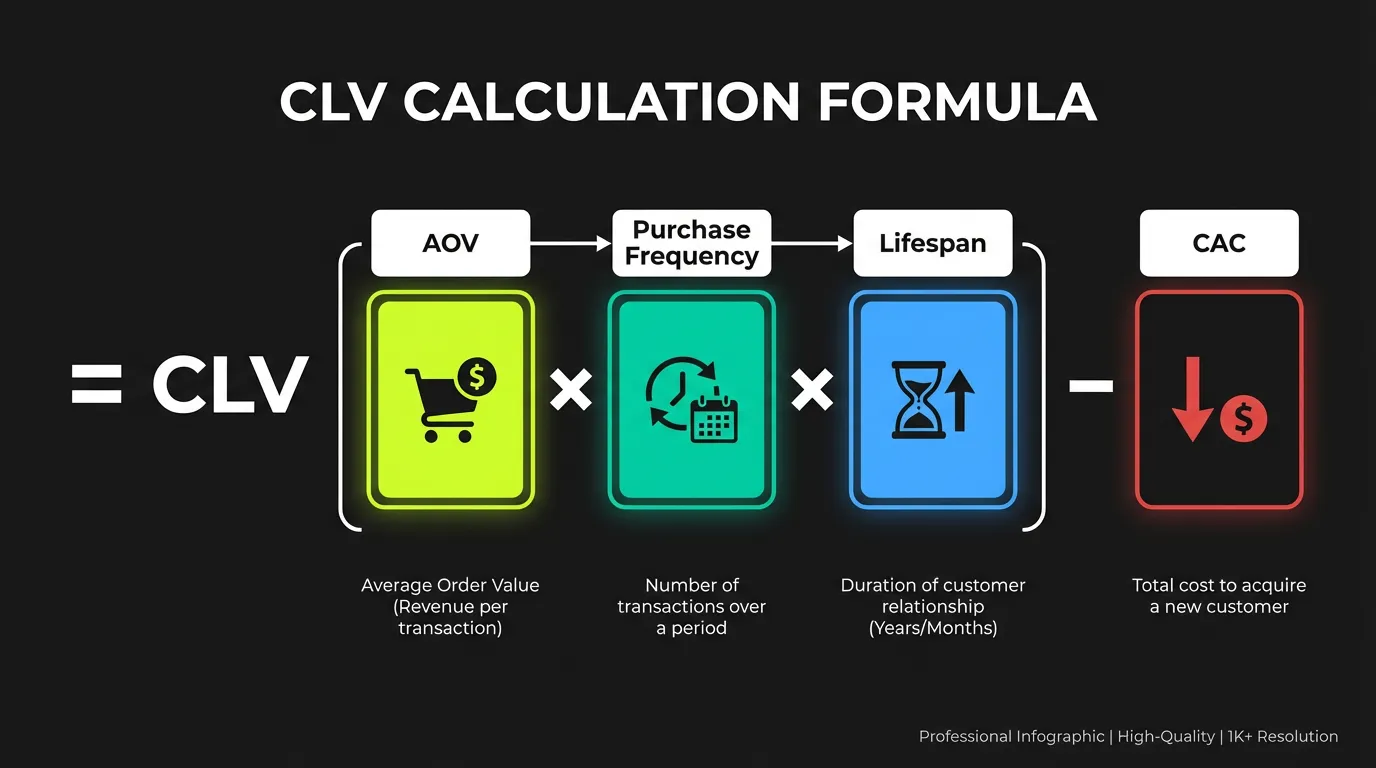

Calculating CLV: Methods That Work

Different businesses need different CLV models.

Method 1: Historical CLV

Sum all past revenue from a customer:

Historical CLV = Total Revenue - Total Costs

Example:

Customer spent: $500 over 2 years

COGS: $200

Service costs: $50

Historical CLV: $500 - $250 = $250

Method 2: Predictive CLV

Model future value based on behavior patterns:

Predictive CLV = (T × AOV × AGM × ALT) / Churn Rate

Where:

T = Average monthly transactions

AOV = Average order value

AGM = Average gross margin

ALT = Average customer lifespan (months)

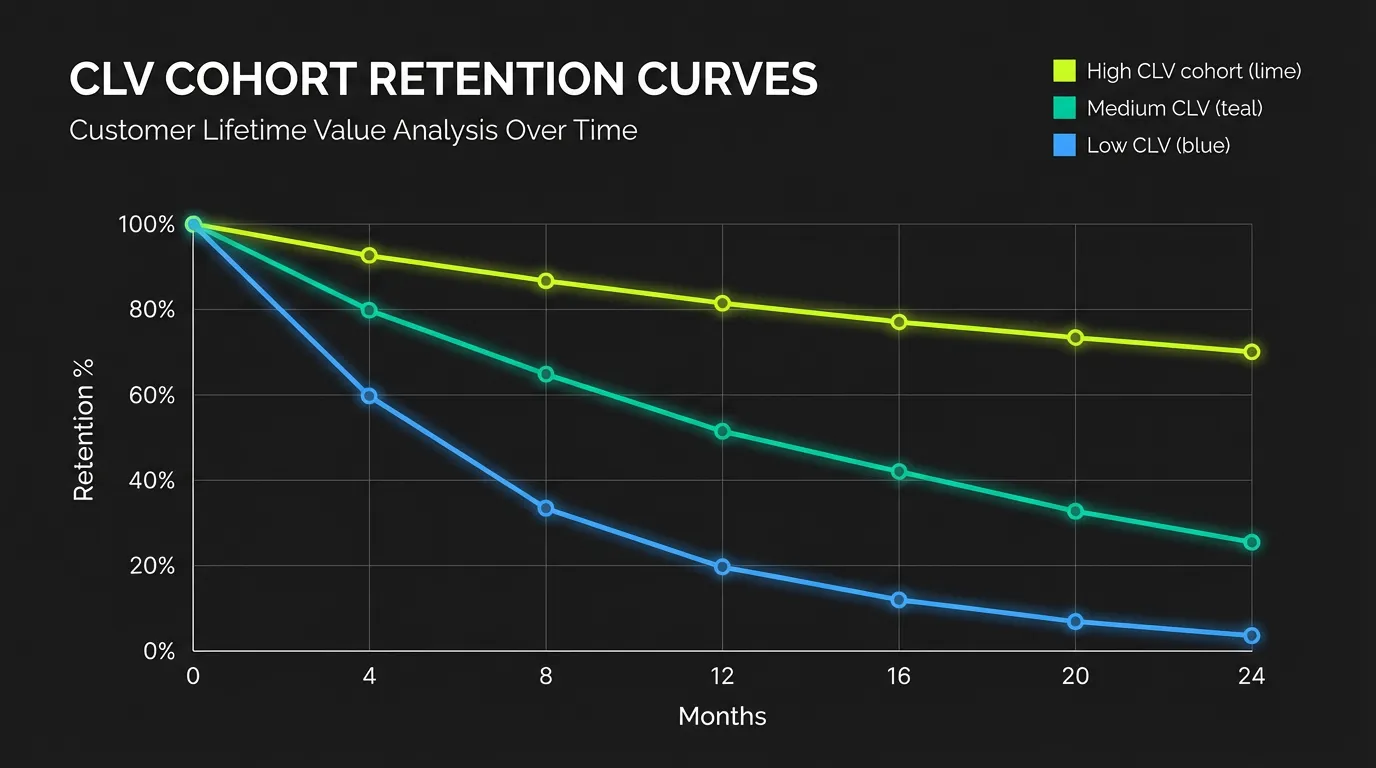

Method 3: Probabilistic Models (RFM + Machine Learning)

Advanced models using:

- Recency — How recently customer purchased

- Frequency — How often they purchase

- Monetary — How much they spend

These inputs feed ML models that predict future purchase probability and value.

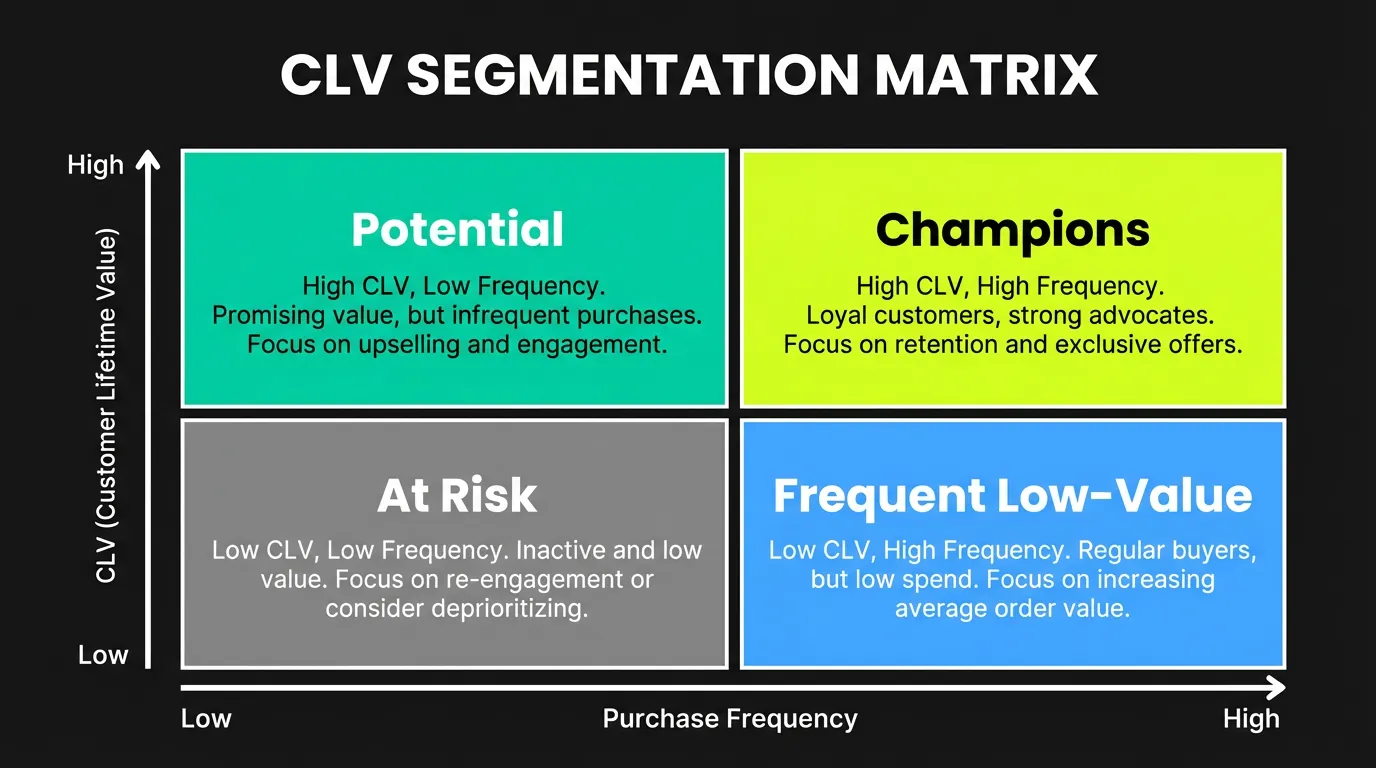

Method 4: Segment-Based CLV

Different customer types have different values:

| Segment | Average CLV | % of Customers |

|---|---|---|

| Premium | $2,500 | 10% |

| Regular | $800 | 50% |

| Discount | $200 | 30% |

| One-time | $50 | 10% |

The LTV:CAC Ratio

The most important metric for sustainable growth.

What Good Looks Like

| LTV:CAC | Interpretation |

|---|---|

| <1:1 | Losing money per customer |

| 1:1 - 2:1 | Marginally profitable, needs improvement |

| 3:1 | Healthy, sustainable growth |

| 5:1+ | Strong unit economics OR underinvesting in growth |

Calculating by Channel

Track LTV:CAC for each acquisition source:

| Channel | CAC | 12-mo LTV | LTV:CAC |

|---|---|---|---|

| Organic Search | $15 | $180 | 12:1 |

| Google Ads Brand | $35 | $160 | 4.6:1 |

| Meta Ads | $55 | $145 | 2.6:1 |

| Google Ads Non-Brand | $85 | $130 | 1.5:1 |

| Influencer | $120 | $210 | 1.75:1 |

> "Channel LTV varies dramatically. Customers from different sources have different intent, expectations, and value. Treating all CAC equally is a mistake."

CAC Payback Period

How quickly you recover acquisition costs.

Why Payback Matters

- Cash flow — Longer payback requires more working capital

- Risk — More time = more churn opportunity

- Growth capacity — Fast payback enables faster reinvestment

Example: $150 CAC / ($30/month × 70% margin) = 7.1 months

Benchmarks by Business Model

| Business Model | Target Payback |

|---|---|

| E-commerce | 3-6 months |

| Subscription (consumer) | 6-12 months |

| SaaS (SMB) | 12-18 months |

| SaaS (Enterprise) | 18-24 months |

| Marketplace | 6-9 months |

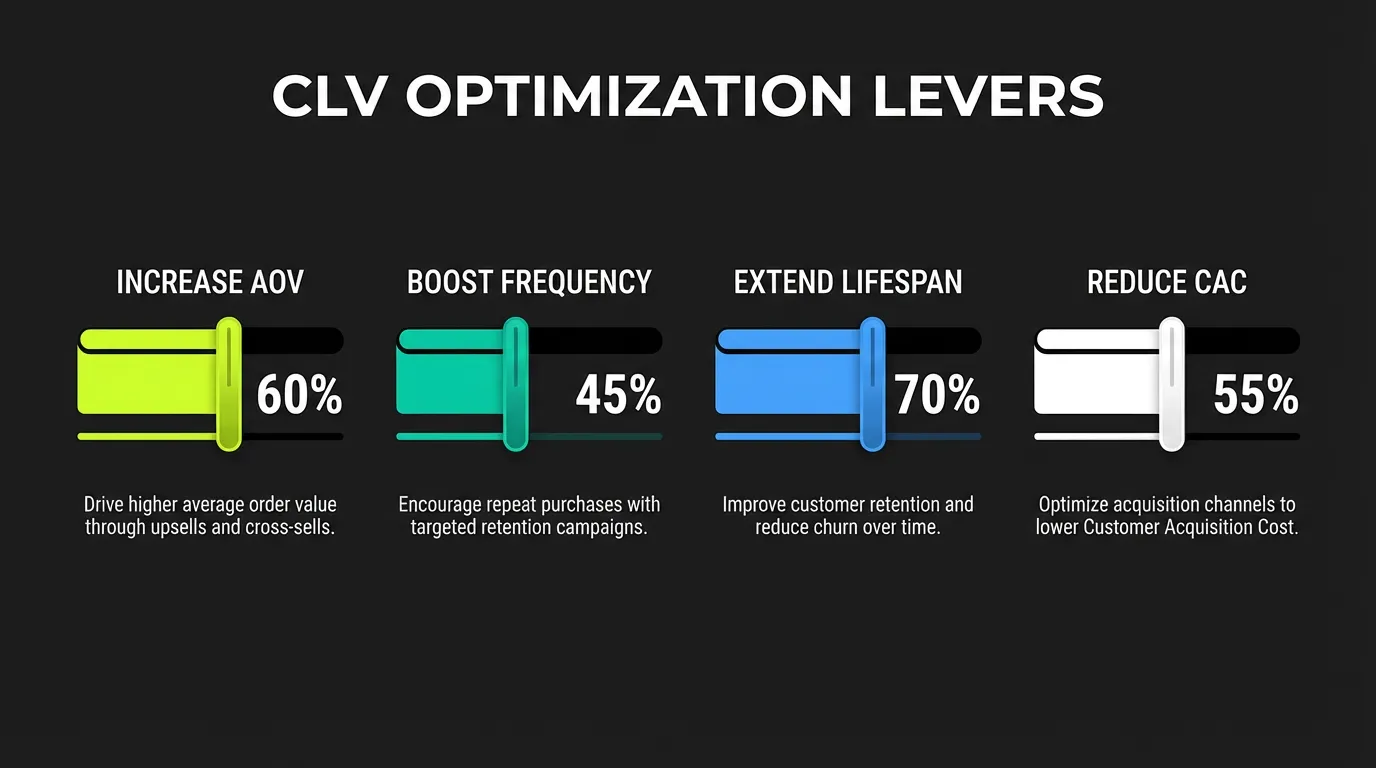

Optimizing Advertising for CLV

How to find customers who stay, not just convert.

Step 1: Build CLV Segments

Create customer tiers based on lifetime value:

Common high-CLV indicators:

- Full-price first purchase (vs discount)

- Specific product categories

- Higher first order value

- Multiple items in first order

- Mobile app user

- Loyalty program member

Step 2: Find Lookalike Signals

Train algorithms on valuable customers:

Step 3: Optimize for LTV Events

Track events that predict lifetime value:

| Event | LTV Correlation |

|---|---|

| Add to wishlist | 2.1x higher LTV |

| Create account | 1.8x higher LTV |

| Subscribe to email | 1.6x higher LTV |

| Download app | 2.4x higher LTV |

| Second purchase | 3.2x higher LTV |

Optimize toward these events, not just first purchase.

Acquisition Strategies by CLV Goal

Strategy A: Maximize LTV (Premium Acquisition)

Approach: Accept higher CAC for significantly higher LTV Tactics:- Target higher income demographics

- Focus on brand awareness + consideration

- Premium creative with quality signals

- Limited discounting

- Retarget engaged non-converters longer

Strategy B: Optimize LTV:CAC Ratio

Approach: Balance acquisition cost with lifetime value Tactics:- Bid based on predicted CLV

- Channel mix optimization by LTV

- Micro-segmentation of campaigns

- Suppress low-LTV lookalikes

- A/B test creative for LTV impact

Strategy C: Minimize Payback Period

Approach: Acquire customers who pay back quickly Tactics:- High-intent keyword focus

- Retargeting warm audiences

- Upsell/cross-sell in acquisition flow

- Bundle promotions

- Annual vs monthly pricing push

Creative Strategy for High-CLV Acquisition

Ad creative influences who you attract.

Discount vs Full-Price Messaging

- Higher brand loyalty

- Lower price sensitivity

- Less likely to wait for sales

- More likely to refer others

- Price-motivated

- Higher churn rate

- Wait for next sale

- Lower engagement between purchases

Creative Elements That Attract High-CLV

| Element | Impact on CLV |

|---|---|

| Quality imagery | +15-20% LTV |

| Brand storytelling | +20-25% LTV |

| Customer testimonials | +10-15% LTV |

| Product education | +15-20% LTV |

| Urgency/scarcity | -10-15% LTV |

| Deep discounts | -30-50% LTV |

Retention's Impact on Advertising

Retention makes acquisition profitable.

The Retention-CLV Math

| Monthly Churn | Annual Retention | CLV Multiple |

|---|---|---|

| 10% | 28% | 1.0x (baseline) |

| 5% | 54% | 1.9x |

| 3% | 69% | 2.5x |

| 2% | 79% | 3.1x |

| 1% | 89% | 4.2x |

> "A 5% improvement in retention can increase CLV by 25-95%. The most profitable advertising investment is often in keeping customers you've already acquired."

Acquisition + Retention Flywheel

Acquire high-CLV customers

↓

Retain through great experience

↓

Increase repeat purchases

↓

Generate referrals

↓

Lower effective CAC

↓

Higher LTV:CAC ratio

↓

Reinvest in acquisition

↓

(Repeat)

Measuring CLV in Ad Platforms

Google Ads: Conversion Value Rules

Set different values by audience:

- Audience lists (high-value customers)

- Location (markets with higher LTV)

- Device (if app users have higher LTV)

Meta: Conversion API with LTV

Send actual customer value through CAPI:

This trains Meta's algorithm on actual customer value, not just conversion count.

Building CLV Dashboards

Track these metrics monthly:

| Metric | What to Monitor |

|---|---|

| Average CLV | Is it increasing over time? |

| CLV by cohort | Are recent customers more/less valuable? |

| CLV by channel | Which sources bring valuable customers? |

| LTV:CAC trend | Is unit economics improving? |

| Payback by channel | Where is capital recovering fastest? |

Advanced CLV Strategies

Predictive CLV Modeling

Use machine learning to predict value at acquisition:

Input features:- First purchase amount

- First purchase category

- Acquisition channel

- Device type

- Geographic location

- Time to first purchase

- Marketing touchpoints

CLV-Based Bid Strategies

Set bids based on predicted customer value:

Target CPA by CLV Segment:

├── High CLV (top 20%): Target $120 CPA

├── Medium CLV (middle 50%): Target $60 CPA

└── Low CLV (bottom 30%): Target $25 CPA

Why: All are profitable if CAC < 1/3 LTV

Negative Targeting for CLV

Exclude audiences likely to have low CLV:

- Serial returners

- Heavy discount seekers

- One-time purchase patterns

- Low engagement segments

- High churn prediction scores

Common CLV Mistakes

1. Ignoring Time Value of Money

"A customer worth $1,000 over 5 years = $1,000 value"

Reality: Apply discount rate. $1,000 over 5 years at 10% discount rate = ~$620 present value.2. Confusing Revenue with Profit

"Our customers spend $500 average, so CLV = $500"

Reality: CLV should reflect contribution margin after COGS, fulfillment, and variable costs.3. Optimizing for Average CLV

"We optimize for average customer value"

Reality: Optimize for marginal CLV. The question isn't "what's average customer worth?" but "what's the NEXT customer worth at this CPA?"4. Not Segmenting CLV

"All our customers have similar value"

Reality: CLV follows power law distribution. Small changes in which customers you attract dramatically affect average CLV.5. Short-Term Measurement Windows

"We measure 30-day ROAS to judge campaigns"

Reality: 30-day windows miss repeat purchases. Use blended metrics that account for future value.The Bottom Line

CLV-based advertising is about playing the long game:

> "The businesses that win in 2026 won't be the ones acquiring the most customers. They'll be the ones acquiring the right customers—those whose lifetime value far exceeds acquisition cost."

AdBid helps you track customer lifetime value across acquisition channels. See which campaigns bring customers who stay. Start your CLV analysis.

Ready to optimize your ad campaigns?

Try AdBid free for 14 days. No credit card required. See how AI-powered optimization can transform your advertising.

Related Articles

Using LTV Prediction to Transform Your Advertising ROI

Proven Ways to Increase ROAS in 2026

Lookalike Audiences Guide 2026

CAC Optimization Guide 2026

SaaS Advertising Guide 2026

Growth Marketing Guide 2026

More in Guides

View all →

The Complete Guide to AI-Powered Ad Optimization in 2025

Understanding Meta Advantage+ Sales Campaigns: 2025 Guide

Meta Advertising Policies in 2025: What You Need to Know

How to Scale Mobile App Advertising in 2025

The Ultimate Guide to Google Ads Automation Tools